As satisfying as homeownership might seem, you are bound to consider many crucial factors before sealing a deal.

One such factor is the type of house that will be most suitable for your needs. If you have a tight budget and aren’t interested in detached houses, condominiums and townhouses are the two most popular house types to consider.

You might’ve already heard of these terms in the course of your research to date, but are you confident about figuring out the option that will be more convenient? After all, there are several similarities as well as differences between them that you must consider. And you can make an ultimate decision only after weighing the benefits and disadvantages of both these types.

So, we’ve made things simpler for you by drawing a detailed comparison between the two. Read on to know more.

Condo Vs. Townhouse

These two properties are similar in a few ways but have many significant differences as well. We’ll begin by defining each type of property to help you get the hang of the basics before moving on to compare the two.

Defining Condos And Townhouses

A. Condominiums

Condo units, as they’re also called, are individual living spaces in a building or a community of many buildings. Note that the living space or airspace within condos tends to be owned by an individual, as opposed to apartments where space might be rented from a landlord.

But the space other than the interior, such as a recreation center or a pool, is owned by all members of the condo community. Plus, the co-ownership of condo developments extends to the common parts of the structures and land.

B. Townhouses

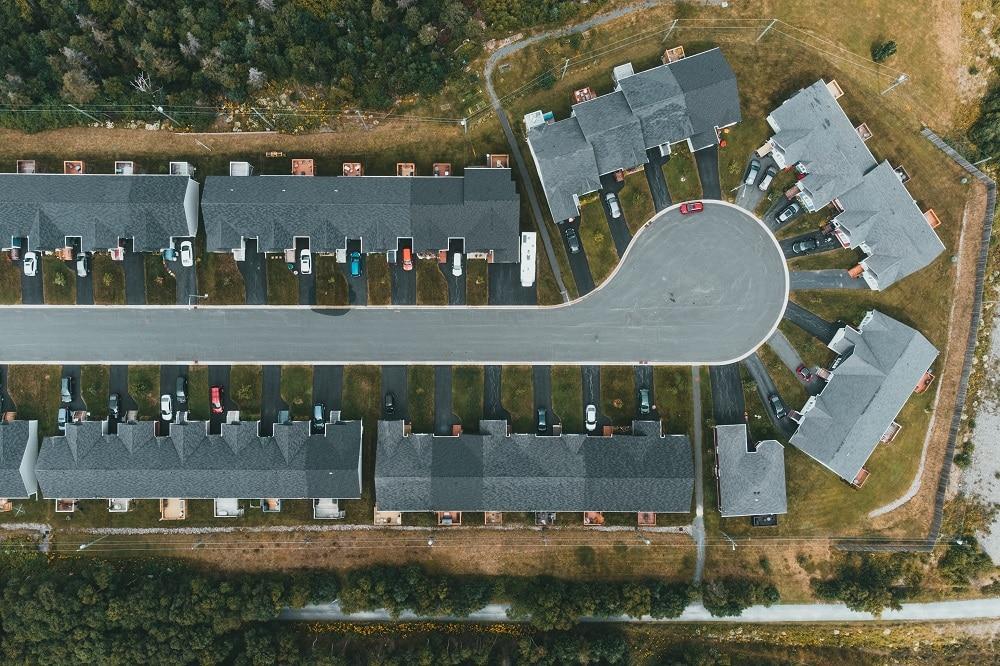

A townhouse, on the other hand, is a building style that’s typically an attached structure consisting of 2 stories or more with common walls. A point worth noting here is that the townhouse owner owns the land along with the structure.

In comparison, the land in condo communities might not belong to the owner — that’s the most significant difference between these two types.

How Are They Similar?

A major similarity between condos and townhouses is the presence of common walls in their structures. Most townhouses share one or two walls with a neighboring unit, with the ending units in a townhome community sharing just one wall. On the other hand, condos can potentially share more walls and even the floors and ceilings based on the unit design.

Another point of similarity is that both these ownerships include access to Common Interest Communities in most cases. This implies that property owners have shared interests in amenities, such as pools, parks, clubhouses, and community centers. And the owners of these units fund such amenities through dues or fees.

The money and community maintenance costs are managed by homeowners associations, while in the case of condominiums, such an association is known as a “condo association.”

Comparing The Two

Now, it’s time for a closer look at the essential determinants that can help you choose between a townhouse and a condo.

1. Ownership

The primary differences between a townhouse and a condo are associated with ownership. Since buying a condo implies you’re buying the interiors of a building unit, you get a fractional co-ownership of the other common amenities.

On the other hand, townhouse owners own the land on which the home is built. In several cases, there’s a front yard and a private outdoor space at the backside that you also own.

As mentioned earlier, the common spaces and amenities in a condo are the property of the Homeowners’ Association (HOA) though the residents use them. The association is responsible for the maintenance of such amenities by collecting monthly HOA fees.

2. Architecture

While drawing a comparison between condos and townhouses, the structure and overall appearance is another important criterion to consider.

Condos are a part of larger buildings similar to apartments and share at least one wall. Their structure is such that they’re likely to have neighbors both below and above. In fact, the architecture of condominiums and apartments are so similar that it’s nearly impossible to distinguish between them. But a condo is an apartment of which you are the owner.

Townhouses might also share walls, but their structure is more similar to a detached single-family home. These homes have two stories and are placed side by side, similar to row houses or brownstone houses on the East Coast. In some cases, townhouses may have a single-level structure which is commonly called “patio home.”

3. Insurance

Owing to the difference in the ownership of these two types of properties, the insurance required for each type is also different.

Insurance for the condo buildings and the land beneath the complex is taken care of by the condo association and not the individual condo owners. The association buys a policy for which the condo residents pay equally in their quarterly, annual, or monthly fees.

Each condo owner or resident must have insurance to protect the interiors of the unit and their belongings in case of unforeseen damage. Moving on to a townhome, the owner of such properties may need a homeowners’ insurance policy since they hold the title to the land and other outdoor areas.

Keep in mind that such a policy will cover liabilities, such as storm and fire damages, while earthquake or flood insurance is optional. Some associations might also provide insurance for the structures, in which case the townhome owners will need a renters’ policy to cover the owner’s belongings.

4. Cost

When you’re planning to move to a new condo or townhouse, the cost is one of the primary considerations. Though both are generally more budget-friendly options than detached homes due to community-centered residential arrangements, they are different in several ways.

Condos are typically cheaper to purchase since ownership is limited to the interior space of the unit. And owing to lesser square footage, the owners incur less on insurance and property taxes. Neither do they have to spend on insurance or taxes for the rest of the complex or building.

In the case of townhouses, the taxes involved and purchasing price is generally more due to greater square footage and maintenance requirements.

5. Property Taxes

The property tax required annually for any home is determined by two factors – the assessed value of the home and the local mill levy. Note that the former variable is determined by an assessor by considering features, such as the size, number of rooms, square footage, and even the properties nearby.

On the other hand, the mill levy value depends on the quality and number of local amenities. The services and amenities that affect this value include libraries, public schools, fire departments, police departments, trails, parks, etc. Naturally, the areas with more services and amenities will come with a greater mill levy.

This implies that the tax payable for townhouses and condos will vary with their location and other features mentioned above. But since both these homes tend to be smaller than detached homes, the taxes are comparatively lower. Not to mention, the sharing of areas and amenities helps to lower the property tax.

6. Fees

A major part of the cost you’ll incur for such homes is the fees payable to the development association for taking care of the shared amenities. Remember that the HOA fees will vary based on the association in consideration.

But on the whole, condo associations are in charge of more amenities and maintenance requirements compared to a townhouse, such as snow removal and lawn care. Hence, the condo HOA fees are generally more costly.

Since townhome owners have more maintenance responsibilities and fewer amenities than condos, the fee is generally lower.

7. Privacy

You must ascertain whether you’ll have privacy in the new home.

Know that condominiums are less private than townhomes due to more shared amenities and common walls and areas. In comparison, townhomes have separate entrances and fewer common walls, with some yard space, so they can offer ample privacy to homeowners.

But convenience is a great benefit that both townhome and condominium owners enjoy. A townhouse needs minimal exterior maintenance, which isn’t required at all for a condo. Plus, the amenities available for both types of homes decrease the need to move out of the community for activities, such as workouts or swimming.

Yet another advantage is a sense of belonging in the community, especially for those who love social interaction. The majority of development associations have community events and a clubhouse. So, if you enjoy such periodic interactions, a townhome or condo may just be the right choice for you.

8. Resale Value

The resale value of your home will depend on several market determinants, many of which will be outside your control. But if you consider the factors that can be controlled, both townhomes and condos are beneficial in some ways.

A well-run HOA will make sure the general landscaping and common areas are in their best shape, so you won’t have to be concerned about making a nice first impression. That said, you’ll be responsible for ensuring that the home itself is fit for reselling. The availability of stunning poolsides or well-kept open spaces might also add extra incentive for the buyers.

You should know that condos tend to appreciate slower in value compared to other properties. However, some modern condos are designed in a way that they can surpass even detached homes in terms of their appreciation rate.

The Concerns Of Townhome And Condo Owners

Aside from the several benefits of opting for a condo or a townhouse, there are certain disadvantages as well. And you must be aware of them before finally deciding to purchase such a home:

1. More Rules And Regulations

If you choose to stay in a condo or townhouse community, you’ll have to adhere to several regulations, rules, and covenants. These have been instituted to enhance the appeal of the community.

While the restrictions might seem more than enough to some, they may be appealing to others. The failure to stick to the guidelines set by condo or townhouse communities can often lead to fines, warnings, and property liens in extreme cases. So, you’ll need to become familiar with the restrictions of any community that you’re considering living in.

2. Pet Restrictions

Many homeowner associations might implement restrictions on the pet breeds that are allowed in the houses or their weight. That said, these restrictions are essentially imposed on the “dangerous breeds” or those weighing over 45 lbs.

3. Limited Parking

Condominiums generally come with limited parking options, which consist of outdoor parking or carports in some assigned spaces. As for townhomes, they don’t offer many options either, though they are more likely to have a single-occupancy garage.

Buying A Townhouse Or A Condominium

After you decide on purchasing a townhouse or condominium, you’ll need to keep in mind the following points:

1. Governing Documents

One of the first steps is to understand the regulations and rules of the region where you’ll reside. Irrespective of whether you’re buying a townhouse or condo, you’ll be staying in a community controlled by a covenant. The purchase will be accompanied by certain expectations, and one of them is adhering to the covenant.

When you close an agreement to buy a property, it signifies that you agree to abide by the rules. Note that the penalties for not adhering to the rules will start with a small warning and will be followed by a potential fine. In extreme cases, it might even end with a lien.

Since you would never want to have such experiences, it’s best to read the governing documents before agreeing on the property.

2. Pricing

Pricing consistency is among the most appealing aspects of buying a townhome or condo. Since these units are similar in many ways, the pricing is simple to handle in both cases compared to a single-family property.

So, unless the unit has certain truly unique characteristics, it’s easy to use models of comparative pricing to determine the worth of a unit.

3. How The Management/Board Deals with Owners

Another crucial piece of information you need to obtain from current unit owners is how the management group and board deal with their requests. There should be a respectful and cooperative relationship between the two parties. This will ensure all important activities and procedures after ownership is conducted smoothly and are totally fruitful.

4. Find Out The Current Issues

It will be beneficial if you speak to the current unit owners on the impending issues concerning ownership and the way the community is being run. Ensure that there aren’t any major issues that might need special assessments. And in case there’s one such issue, you may want to know whether the reserve fund of the community is big enough to handle it.

On a side note, owners ultimately have to pay for repairs, maintenance, and upkeep, so you should know whether a larger expense is looming before you seal the deal.

Financing Such Homes

If we compare the financing options for a townhouse and condo, they’re more or less similar to that for a single-family home. The only difference that might affect the financing of such homes is the lender’s risk involved.

As condominiums pose greater risks for lenders, the rate of interest will be slightly higher. But you can bring the interest rate down on a particular loan with a bigger down payment of at least 20%.

Sometimes, the lender might review the development requirements prior to granting the loan. This review helps assess the risk associated with factors, such as the potentially risky management aspects of the project and the reserve funds.

Also, a primary requirement for eligibility is the number of units occupied by owners at that point in time. Other significant factors include the availability of reserve funds and the strength of the balance sheet.

Another factor affecting the development of a condominium is the eligibility for financing the home through the government, related to the availability of VA and FHA loans. To help sanction such loans for a townhome or condo, the development must be eligible as per the VA or FHA standards. And you must ascertain whether the development is free of all litigations.

Selling Such Homes

Like many of the other criteria which we used to compare the two house types, reselling them presents quite different challenges compared to a single-family home. First of all, know that a condo or townhome market may be seasonal, and if a property is situated in any resort, it will be best to wait for the peak season.

Since these properties are quite similar to each other, potential buyers can easily figure out the worth of a unit on the basis of historical sales. So, unless there is a truly unique characteristic to the condominium, the costs will be somewhat similar.

The trick will be to maximize the profit without risking a lengthy time on the market, appraisal problems, or overpricing the property. This is especially applicable if you’re pitching the home in a seasonal market.

It’s also important to practice transparency while selling a townhome or condo. Since such properties are part of housing associations, in a way it amounts to selling the particular association. That’s why you should make it simpler for potential buyers to obtain information about the development of the home.

This would mean providing access to newsletters, governing docs, and other relevant information to help them decide whether the home is ideal for them.

Keep in mind that they will ultimately learn about the surroundings and neighborhood, so concealing any information will only prolong the inevitable. Thus, following a transparent approach is much more desirable than wasting money and time when you provide buyers something different from what they were promised.

Final Thoughts

To sum up, when it comes to deciding between a townhouse or condo, the choice depends on your priorities. So, think about what matters more to you — is it the convenience, privacy, or affordability?

If you’re a first-time homeowner looking for convenience but aren’t fully equipped to handle ownership responsibilities, a condo might be better. However, townhouses are more favorable for growing families who value enough outdoor space and a safe environment fostered by close-knit communities.

While considering the financing, make sure to check the mortgage rates as on date and apply a mortgage calculator. If you’ve found the right option and just require financing, roping in a reliable financier who will offer the best rate is crucial.

So, do your research accordingly, and with that, we’ll sign off for today. But stay tuned as we’ll soon be back with more guides!